The revolution that the Peer-to-Peer (P2P) payment application has brought in the field of finances and especially how people manage their finances today is huge. With the ability to make transactions from anywhere and at any time, you literally are carrying a mobile bank with you in your pockets all the time.

With this being said, let’s delve a little deeper into the world of P2P payment apps in this article. More precisely, to examine the benefits of P2P apps, the market environment at the moment, growth potential, underlying technology, integration of P2P apps with financial institutions, key features, difficulties of P2P payment app development, and fascinating future trends.

So, without further ado, let’s jump into the article and learn about Peer-to-Peer payment Apps a little more. Why wait, then? Let begin!

In This Article

What Are P2P Payment Apps and Their Game-Changing Advantages?

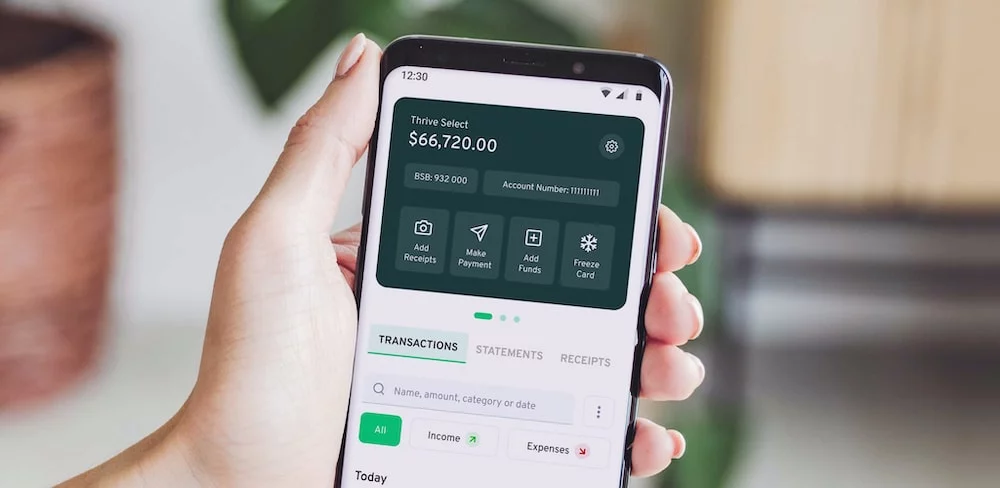

P2P payment apps come under the category of financial apps that let you make digital payments which the need to go to the bank. Having a P2P payment app on your phone is like carrying a bank branch around in your pocket in a much more convenient way. Some examples of these apps are Venmo, PayPal, and Cash App. These apps have earned our confidence over the years and are now indispensable:

Lightning-Fast Transactions

One of the main advantages of P2P applications is that these apps provide very immediate money transfers without the need to visit your bank. Now, all your transactions, whether transferring money for rent, sending immediate financial assistance to a friend, dividing the cost of a meal with pals, etc, can be made in seconds.

Simplified Bill Splitting

Another advantage of the P2P payment apps is the ease of splitting bills. Gone are times of awkwardness when you need to ask others for their share of expense. P2P apps include the split bill feature that splits the expenses between each user, making it simpler and less awkward than ever before to divide expenses with friends, coworkers, or housemates.

24/7 Accessibility

When it comes to banks, you cannot visit them any time you want. You can visit the bank only during bank hours, but P2P applications shatter the restrictions of banking hours. With the P2P app, you don’t need to worry about holidays and weekends, as you can send and receive money when you want.

Security and Privacy

One thing that bothers everyone when it is something concerning money is safety and security while making a transaction. But these P2P apps take the security of your financial data as well as transaction very seriously. Your transactions and details are safe and secure with strong authentication and encryption procedures, which are most trusted.

User-Friendly Interfaces

Transaction is something that every person makes, irrespective of age or level of technological sophistication. Therefore, instead of a very complicated interface, most of these P2P apps come with user-friendly interfaces so that anyone can use them easily.

Growth Potential and Future Trends

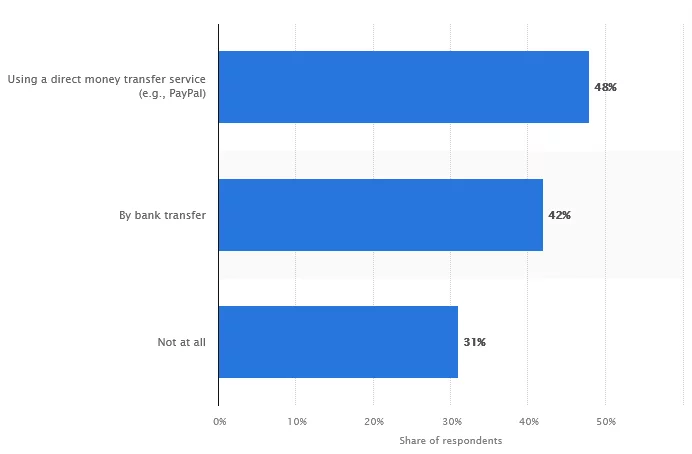

Industries that offer P2P payment services are growing exponentially and have an incredible growth potential. According to one survey by Statista on “Peer-to-peer payments,” shows that 48% of Americans use a direct money transfer service (e.g. PayPal).

This is just one figure, and as more individuals are shifting towards digital financing, leaving behind the orthodox methods of financing, we can anticipate a large number of fascinating advancements in the sector, including

| Global Expansion | Blockchain Integration | Financial Services Integration |

| P2P apps are becoming more and more popular across the world as now sending money is as simple as sending a text message. | To improve security and lower transaction costs, investment in blockchain technology is also going on. This integration of Blockchain technology will alter the way you used to think about financial transactions. | Expansion in the services offered by P2P apps is also on the cards. In coming years, you cannot just make transactions but can also get micro-loans, make investments, and operate savings accounts from these apps. |

The Current P2P Payment App Market

Here is the list of P2P payment apps in the market that are widely in use:

PayPal’s Venmo

Venmo is one P2P app that is most popular among millennials and Gen Z. With its social feed and accompanying emoticons, Venmo is a go-to app for young adults where they can split bills and share expenditures.

Square’s Cash app

Square’s Cash is more than just a P2P app. On this app, you can not just split bills and make transactions but can also buy stocks and bitcoin.

Zelle

Do you want to send money straight from your bank accounts to the receiver? Zelle is the one app for you. With its flawless interaction with banks, Zelle has become well-known in the market of P2P payment apps.

Google Pay

Google Pay is one P2P payment app that blends P2P transactions with the ease of NFC-based in-store transactions, making it the next most used app after PayPal.

The Tech Behind P2P Payment Apps

After knowing about the main contender in the market of P2P payment apps, let’s understand what makes these apps safe to use and how safe transactions are made using them:

- Encryption: In order to safeguard your financial details during transfers, these P2P applications use industry-standard encryption techniques. Your cash and personal data are kept private with the help of end-to-end encryption techniques.

- Tokenization: Tokenization is an additional layer of security. These applications utilize tokens—random, one-time codes—to secure your information rather than sending your actual credit card or bank account information.

- Biometric Authentication: Before using any P2P app, you need to authenticate yourself either with fingerprint scanning or face scanning.

Integration with Financial Institutions: APIs and SDKs

After knowing the security and safety major taken to secure your money and data, let’s try to understand how these P2P apps communicate with banks.

So developers actually use Application Programming Interfaces (APIs) and Software Development Kits (SDKs) to communicate with your banks. Using APIs and SDKs, your P2P app safely accesses your bank accounts and makes transactions. The use of pre-built tools and resources that SDKs give developers decreases the time and effort needed to connect with financial institutions, and transactions can be made in seconds.

Key Features: Security, Privacy, and Regulatory Compliance

It is important to protect users’ personal information and financial assets, and this is the reason why P2P payment apps prioritize security and privacy. The following main characteristics help these apps to earn the confidence of their users.

| Two-Factor Authentication (2FA) | 2FA authentication is a double-layer protection that means even if someone obtains your login information, they wouldn’t be able to actually log into your account as they need access to the verification code. |

| Privacy Settings | P2P apps know how important privacy is, especially when money is concerned, and therefore these apps allow you to choose whether you want to keep your transaction private or open. |

| KYC and AML Compliance | KYC and AML are other safety measures that help these apps prevent illicit activities like money laundering and fraud. |

Challenges Faced by P2P Payment App Developers

Though P2P payment apps are quite popular these days, still, there are still some challenges that the software developers deal with behind the scenes:

- Competition: One of the major challenges is posed by the growing competition. Therefore there is a constant need to think of new features and enhancements to maintain the position in the market.

- User Acceptance: Though people are gradually shifting to online payment methods still, there are people who don’t trust P2P apps. And persuading consumers to believe in and utilize new apps is no less than a challenge.

- Technology Development: Advancement in technology is never never-ending process, and keeping up with constantly changing technology is crucial in order to provide a superior user experience, which in itself is a challenge.

Emerging Trends in P2P Payments

P2P payments have promising potential for the future:

- Blockchain Integration: To improve security and lower transaction costs, investment in blockchain technology is also going on. This integration of Blockchain technology will alter the way you used to think about financial transactions.

- Financial Services Integration: In the near future, these P2P apps will emerge as full-fledged financial centers. This implies you cannot just make transactions but can also get micro-loans, make investments, operate savings accounts, etc, from these apps only.

- Cross-Border Payments: P2P applications will be essential in facilitating smooth cross-border payments. In the coming year, you don’t need to pay extract money to make transactions across borders.

Wrapping Up

With this, I come to the end of this blog, and I hope you are now thoroughly aware of the revolution Peer-to-Peer payment apps have brought in the financial sector. With the ease of use and plethora of services these apps offer, this industry will continue its stratospheric ascent. These apps are no less than a boon to users, a these have covered—securely, quickly, and with the utmost convenience—whether you’re sharing a bill with pals, transferring money to family abroad, or investing in stocks.