Facebook Pay is a revolutionary feature that allows users to make transactions and send money to friends and family within the Facebook platform. This feature is a convenient and secure way to make payments online, but many users may still have questions about how does Facebook Pay work.

Facebook Pay is a feature that has been available for a while now, it allows users to make transactions and send money through the Facebook platform, Its easy-to-use interface and integration with the platform make it more convenient for users to make transactions. The feature is also equipped with robust security measures to ensure the safety of the user’s personal and financial information. It is an awesome feature for Facebook Business Page owners and Marketplace sellers.

In the following sections, we will delve into the intricacies of Facebook Pay, exploring its features and benefits in great detail. We will take a closer look at how does Facebook Pay work, and how it can be used to make online transactions more convenient and secure. So, Let’s get started!

In This Article

How Does Facebook Pay Work?

Before we move ahead, please be aware that as part of the Facebook company’s rebranding to Meta, Facebook Pay is now Meta Pay. If you’re a current Facebook Pay user, there is no action required on your part. All of your existing Facebook Pay details will remain the same in Meta Pay, including account details, payment method, and settings. With this seamless transition, you can continue to make transactions and send money to friends and family within the Meta platform with ease. Let’s take a look at how does Facebook Pay work (aka how does Meta Pay work).

What is Facebook Pay (Meta Pay) and How Does Facebook Pay Work?

Facebook Pay is a digital payment system provided by Facebook, the social media behemoth. It enables clients to buy items and services directly from companies on the network without having to enter their payment information each time. Customers who want to utilize Facebook Pay must first enter their payment, shipping, and personal information into the Facebook app. After saving their information, consumers may use Facebook Pay as a payment method for making purchases on social networking or commercial websites.

Adding Facebook Pay as a payment option to a business’s website is simple, and it connects smoothly with most payment processing and e-commerce systems. Customers may do transactions fast and efficiently with only a few clicks. Facebook Pay is available on numerous platforms, including Facebook, Instagram, Messenger, and Portal, allowing customers to do transactions regardless of where they are on the site.

The feature is also equipped with robust security measures to ensure the safety of the user’s personal and financial information. Facebook Pay uses encryption and multiple layers of security to protect user information and transactions. Additionally, users can also opt for biometric identification methods in place of PINs for added security.

How Does Facebook Pay Work: Facebook Pay Operations

Facebook Pay is a feature that allows users to make transactions and send money to friends and family within the Facebook platform. The process is designed to be seamless and user-friendly, allowing customers to make purchases with minimal effort. In order to use Facebook Pay, users must have a debit card, credit card, or another payment option stored in their Facebook account.

To make a purchase, customers simply check out, indicate they want to use Facebook Pay, and either enter their PIN or use a biometric identification method to complete the transaction. This eliminates the need for customers to enter their payment card information for every transaction.

For small business owners, Facebook Pay is easy to integrate into their e-commerce platforms. Since customers are already logged into their Facebook profiles, online payments are made more efficient. With just a few clicks, customers can make purchases of almost all types of goods and services using Facebook Pay.

How to Set up Facebook Pay for Your Account?

Setting up Facebook Pay on your account is a simple and straightforward process. Here are the steps to get started:

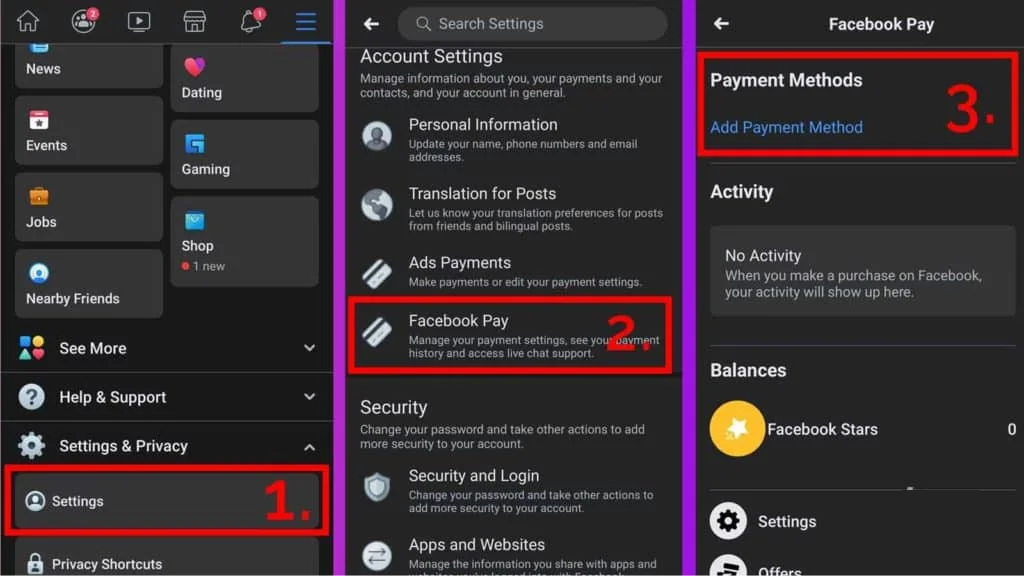

Step 01: Open Facebook on your device and tap on the menu icon.

Step 02: Scroll down and select Settings & Privacy, followed by Settings.

Step 03: Tap on Payments.

Step 04: Tap Add Payment Method.

Step 05: Choose a payment method and add the details.

Step 06: Review your payment methods and tap Confirm.

Step 07: Enter your PIN or use a biometric identification method to confirm your identity.

Once you’ve set up your account and added your payment method, you’re ready to start using Facebook Pay. You can use it to make purchases on Facebook, Instagram, Messenger, or Portal. Keep in mind that you can add multiple payment methods to your Facebook Pay account, so you can switch between them as needed.

You can also view your transaction history and manage your account settings in the Facebook Pay section of your settings. This allows you to view your purchase history, update your payment methods, and make changes to your account settings.

How to Make Purchases with Facebook Pay?

Once you have set up your Facebook Pay account and added a payment method, you can start making purchases on Facebook, Instagram, Messenger, or Portal. Here’s how to use Facebook Pay to make a purchase:

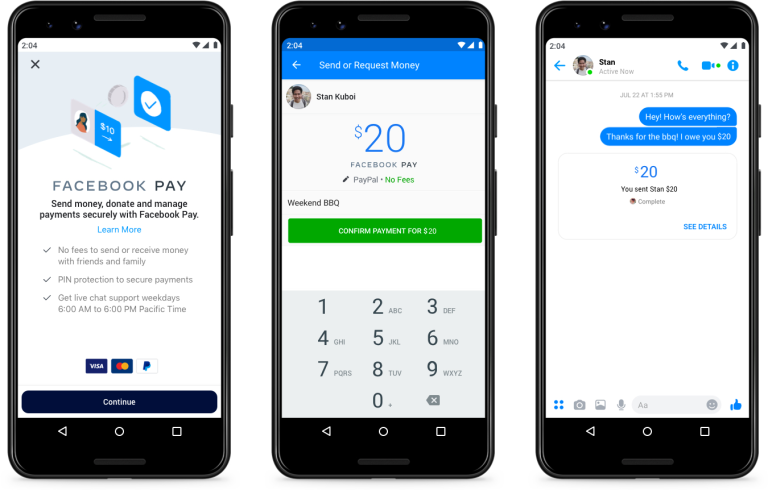

Step 01: Find a product or service that you want to purchase, and tap on the Buy Now or Checkout button.

Step 02: On the checkout page, select Facebook Pay (now Meta Pay) as your payment method.

Step 03: Review the details of your purchase, including the price and shipping information.

Step 04: Tap on Place Order to complete the transaction.

Step 05: Enter your PIN or use a biometric identification method to confirm your identity.

When you use Facebook Pay to make a purchase, the payment will be processed securely, and you’ll receive a receipt for the transaction in your Facebook account. You can also view your transaction history and download receipts in the “Facebook Pay” section of your Facebook settings.

It’s important to note that the availability of Facebook Pay will vary depending on the country or region you are in. Also, some businesses or merchants may not accept Facebook Pay as a payment method.

How Does Facebook Pay Work: Security and Privacy

Security and privacy are of the utmost importance when it comes to online payments, and Facebook Pay is no exception. Here’s what you need to know about the measures in place to keep your information secure and private when using Facebook Pay:

Encryption: All sensitive information, such as payment and personal details, is encrypted and stored on secure servers. This means that even if someone were to gain unauthorized access to your account, they would not be able to read your information.

Two-factor authentication: An additional layer of Facebook 2FA security is added by requiring a one-time code to be entered when accessing your account from a new device or browser.

Fraud detection: Facebook Pay uses advanced fraud detection systems to detect and prevent suspicious activity on your account.

Compliance: Facebook Pay follows all relevant laws and regulations, including the Payment Card Industry Data Security Standards (PCI DSS).

Privacy: Facebook Pay is committed to protecting your privacy and only uses your information for the purposes of processing payments and providing customer support. You can review their privacy policy to learn more about how they use your information.

By following these security measures, Facebook Pay ensures that your information is protected and your transactions are secure.

How Does Facebook Pay Work: Assessing Advantages and Disadvantages

The use of Facebook Pay by a corporate organization has both advantages and pitfalls. On the one hand, integrating Facebook Pay may give several benefits, such as accessing a larger client base, since statistics reveal that a major part of customers consider mobile wallet usage to be an important element when making purchases.

Furthermore, integrating Facebook Pay can expedite the checkout process, perhaps leading to higher conversion rates and improved brand reputation. Businesses may also use Facebook Pay to facilitate purchases through their social media accounts and link it with their websites using platforms such as Shopify. Furthermore, it is a low-cost solution with no transaction costs.

On the other hand, there are certain drawbacks to consider when utilizing Facebook Pay for a business. Firstly, not all customers have access to the platform, and even among those who do, there may be a preference to avoid using it. This can result in a lower return on investment when promoting the Facebook Pay option.

Additionally, the integration of Facebook Pay is currently limited to specific website-building platforms, such as Shopify. Furthermore, it may not yet offer the same level of comprehensiveness and widespread usage as established platforms like PayPal. As such, it may not be suitable to replace PayPal entirely for businesses that primarily interact with customers outside of Facebook or Instagram.

Wrapping Up

That concludes this guide on how does Facebook Pay work. I hope this article has provided you with a clear understanding of the process of using Facebook Pay and its features. As a reminder, Facebook Pay is now Meta Pay, and it’s a secure and easy way to make payments on Facebook, Instagram, and Messenger. If you have any questions or need further assistance, feel free to visit Path of EX for more guides and tutorials. Don’t forget to bookmark the site for easy access. Check the site regularly for updates and new information.