Digital payment is a reality mow. There are several players and actors in the fray. Apple is one of the biggest players that accounts for a considerable amount of digital payment. The list of stores that accept Apple Pay payment is long. At the same time, the number of stores where Apple Pay services are unavailable can’t be ignored either. Apple users, at times, get additional offers like Cashback and others with certain terms and conditions. Can You Get Cash Back With Apple Pay? Let us find out.

Users who want to utilize Apple Pay must upload their payment details to Apple Wallet and proceed with the card issuer’s verification process. Once uploaded, all necessary payment information is connected to the app, eliminating the need for the user to handle a card physically when making a purchase. The most recent iPhone models, the Apple smartwatch, iPad, and MacBook models, are among the gadgets that accept Apple Pay.

Apple uses a technique called “tokenization” to keep transactions secure by prohibiting the transmission of actual credit card details over the air. Apple additionally protects purchases using compatible iPhones’ Touch ID or Face ID as well as ongoing skin contact with the Apple Watch.

In This Article

Can You Get Cash Back With Apple Pay at Stores?

You will have the option to get cash back when purchasing at the store using Apple Pay. But there are a few things you should know, such as:

- The store needs to provide cashback.

- Apple Pay needs to be an approved method of payment.

- You must attach your credit or debit card.

Apple Pay users can receive cashback if the business accepts Apple Pay, according to Apple’s customer support team. Through Apple, you can quickly locate businesses that accept Apple Pay, letting you know whether cashback will be offered.

Trader Joe’s, Safeway, and Albertsons are just a handful of the well-known grocery store businesses that accept Apple Pay. Additionally, you must confirm that your location is included in the list.

Therefore, the cashback location must be processed in the same way as every other cashback transaction. The payback amounts will be limited by the business. Additionally, there are no additional cashback fees for any Apple Pay transactions.

Having said that, the way Apple Pay is being used by stores of diverse and wide range, From Starbucks to Culver’s, when it comes to restaurants and grocery store like 7-Eleven, the list goes on with the exception of Lowe’s.

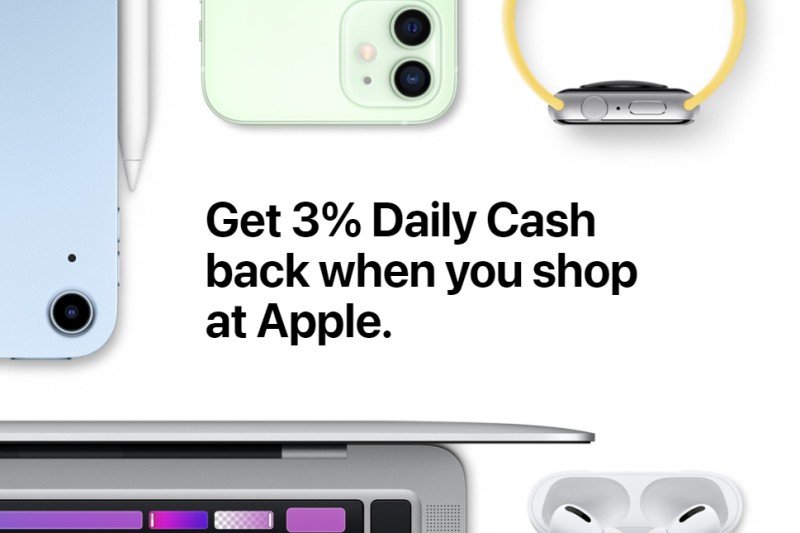

How Much Cashback is Offered Using Apple Pay?

One popular way to cut costs is by utilizing credit cards to earn cash back. Having Apple Pay on your iPhone to make regular purchases, though, could help you earn even more cash back.

Apple Pay often only gets 1% cash back to the users. American Express cardholders can get a larger cashback of about 3% if they use Apple Pay. This is how you can get cash back with Apple Pay.

How Can I Add a Credit Card or Debit Card to Apple Pay?

The procedure is simple. Scroll down to read more about how I can add a credit card or debit card to Apple Pay.

Adding a credit card or debit card for Apple Pay using Google Pay is pretty simple. Your iPhone’s Wallet app is the only place where you’ll need to set up a debit, credit, or prepaid card. You have to add your card details to each device separately if you wish to buy using other gadgets. Currently, the iPhone, iPad, Apple Watch, and Mac all support Apple Pay. Adding these cards can help you get information on whether can you get cash back with Apple Pay.

- For an iPhone, tap the Plus sign in the top right corner of the Wallet app to add a card.

- For your iPad, select Wallet & Apple Pay from the Settings menu, then press to add a card.

- To use Apple Watch, launch the Apple Watch app on your iPhone and select Wallet & Apple Pay. Next, tap to include a card.

- For Mac devices, go to System Preferences, choose Wallet & Apple Pay, and then press to add a card if your machine has Touch ID.

How Does Cashback on Apple Pay Work?

Having an Apple Pay Card could be a great convenience if you frequently use Apple Pay.

The Apple Pay card is identical to a standard credit card, making it easy to make purchases wherever you go shopping. You can get cashback with the Apple Pay card on eligible transactions and items, even in places where the Apple Pay card cannot be used.

The Apple Pay card offers payback through a transfer to your Apple Wallet and is unlimited in comparison to other types of cards. Once placed, you are free to use it however you like. Now you know can you get cash back with Apple Pay.

How to Use an ATM with Apple Pay?

This method will help you in learning a few easy steps to use Apple Pay at an ATM.

- Keep in mind the bank card that you wish to use is already added to your Wallet app.

- Find an ATM that shows an Apple Pay or contactless icon.

- Select your debit card and open the Apple Pay Wallet. The Apple Pay or Contactless icon that you previously found on the ATM should be tapped with your iPhone.

- You must use Face ID or Touch ID to confirm your request.

- If prompted, enter the PIN for your debit card.

- Complete any further procedures displayed on the ATM screen.

How Can You Instantly Cash Out From Apple Pay?

You require a bank account that is connected to your Apple Pay account to cash out instantly through Apple Pay. Money will be sent from your bank to the merchant’s bank when you use Apple Pay to make a purchase. Also, it is clear now can you get cash back with Apple Pay.

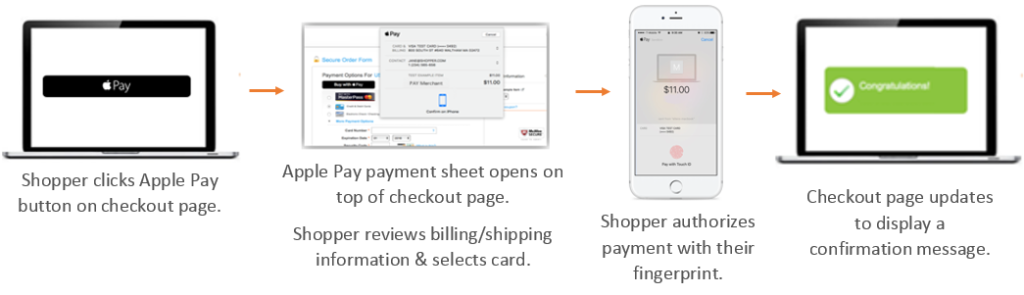

How Can You Pay Using Apple Pay at The Checkout?

To use Apple Pay, bring your iPhone or iPad close to the contactless reader while pressing your finger against the Touch ID sensor. If you’ve linked more than one card to Apple Pay, you can choose which one to use before putting your finger on the sensor.

Wrapping Up

That’s it for this article. So, does Apple Pay give cashback? You can, indeed. As you can see, whether you use Apple Pay in a store, online, or at an ATM, there are several methods to get cash back. I hope it is easy for you now to understand how can you get cash back with Apple Pay.

You don’t need to stress about carrying around additional cards because it is directly linked to your bank account. Additionally, if you own an iPhone X or similar device, you can even make and receive payments from other individuals using Apple Pay Cash.

Frequently Asked Questions

Q 1. Which shops accept Apple Pay and provide cashback?

Ans: Numerous shops, including Adidas, BJ’s, Footaction, GameStop, Lego, Nike, Petco, and Sephora, offer cash back. Restaurants, including Dunkin’ Donuts, KFC, McDonald’s, White Castle, and Subway, also provide cash back.

Additionally, you may use your Apple Pay card at gas stations and supermarket stores (including Costco, FoodMaxx, Macey’s, Save Mart Supermarkets, Walgreens, and Whole Foods Market) (Texaco, ExxonMobil, Chevron).

Q 2. How can I withdraw money from the Apple Pay app?

Ans: Simply launch the Wallet app on your iPhone, tap the Apple Cash card, and then press the + button to add other cards. Go to Settings > Wallet & Apple Pay > Apple Cash Card if you’re using an iPad. Choose “Transfer to Bank” from the menu. Click Next after entering the deposit amount.

Q 3. Does Apple Pay improve your credit?

Ans: Sadly, no, using a digital wallet like Apple Pay won’t directly raise your credit score.

But you may make significant changes to your credit. Ensure that you pay off the balance on your credit cards each month, and aim to reduce your credit record.